2021.11.02Health Insurance in Japan: A Guide for Long-term Residents

One of the greatest things about moving to foreign country is that it’s always full of new surprises – but not all surprises are good. For expats who have come from the United States, you are likely aware of the ever-rising costs that can accumulate with even a quick visit to the emergency room. Then, there is also the story a while ago of an Australian couple who was charged a million-dollar hospital fee in Canada. Bottom line: each country has its own insurance system, and learning about it before your travels can save you unnecessary costs and stress.

While going to a hospital in Japan–where the majority of the healthcare workers only speak Japanese–can seem scary, it doesn’t have to be. And luckily, it is unlikely that expats in Japan will face crushing debt inducing medical costs.

So, what insurance plans are available? And how much are the premiums? Here it shows how you can better prepare yourself for when the unexpected occurs while living in Japan.

How to Apply for Japanese Health Insurance

There are two types of health insurance available to those living in Japan. All persons living in the country–both citizens and expats with long-term visas–are required by law to enroll in either an Employee Health Insurance (kenkô hoken) or the country’s National Health Insurance (kokumin kenkô hoken). However, by an agreement with certain countries, this enrollment can be waived. The deciding factors in which insurance you will be enrolling in is 1) whether or not you work for a Japanese employer and 2) whether or not the Japanese employer offers this health insurance benefit.

Japan Employee Health Insurance

(Kenko Hoken 健康保険)

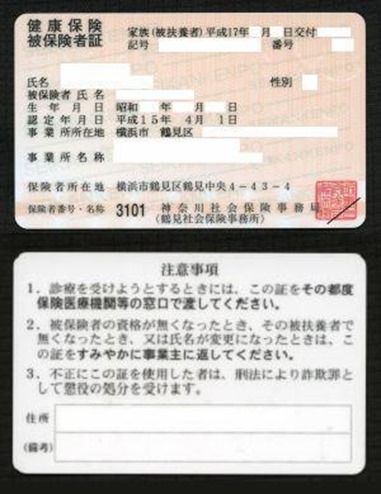

Employee Health Insurance (EHI), as the name suggests, is an employment-based health insurance; meaning, your employer pays half of your EHI premium. The other half is simply deducted from your monthly paycheck. The insurance covers 70 percent of your medical bills (and any of your dependent family members as well).

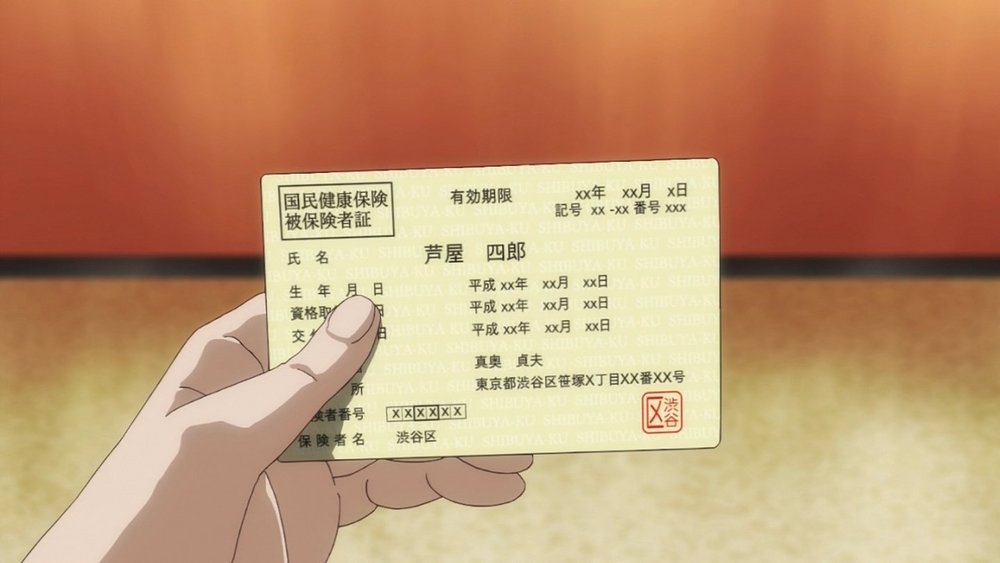

The premium for this insurance depends on your income. For example, the premium for a 30-year-old, single Tokyoite who earns an average monthly salary of 310,000 JPY will be around 15,000 JPY (with the company paying the remaining 15,000 JPY). To register for this type of insurance, all you have to do is become an employee; the Japanese company’s human resource department will take care of the paperwork, and you will soon be issued an insurance card.

Japan National Health Insurance

(Kokumin Kenko Hoken 国民健康保険)

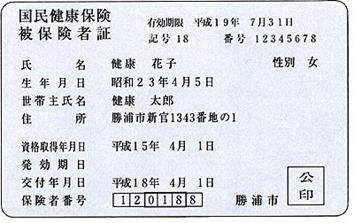

National Health Insurance (NHI), on the other hand, is for those who are under the age of 75 and either unemployed, self-employed (including contractors), or retired, as well as the dependent family members of those just mentioned.

Just like the EHI, the NHI covers 70 percent of your hospital bills. To apply, you must visit the Residential Affairs Division at your local City Office or Ward Office. The premium is based on your age and your previous year’s income.

Long Life Medical Care System

(Choju Iryo Seido 長寿医療制度)

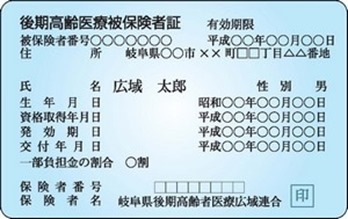

For those who are 75 years and older or are over the age of 65 with a registered disability, the Long Life Medical Care System (chôju iryô seido) is applicable.

Managed by your local government, the premium fees and insurance coverage depends on the insured’s income. For low-income individuals, the insurance may cover up to 90 percent of all medical bills, while for others the standard 70 percent applies.

Private Insurance

While private insurance is rarely directly accepted by Japanese hospitals, it is also the only insurance option for short-term residents. Having to pay medical bills in full upfront and filing a claim may not sound appealing for most, but it will be worth it when the reimbursement is issued.

Foreign travelers and short-term residents visiting for a month or two won’t be eligible to apply for EHI or NHI, but they can still purchase insurance plans from private companies. Some companies, as Viva Vida Medical Life, offer short-term (e.g., 1-, 2-, 3- and 6-month) insurance plans while staying in Japan that cover 100 percent of the medical fees for any illnesses, injuries or hospitalizations totaling up to 1.6 million JPY.

For travelers staying longer than 6 months, companies like HealthOne provide a 1-year plan, on top of their 3- and 6-month plans. All plans cover up to 2 million JPY of hospital and clinic costs.

MPIH Japan is more than just health insurance. We can offer you something that many larger brokers cannot; personal attention from your own personal adviser. You can establish a close relationship with one consultant, because he will know you and your needs and thus is able to offer you the best possible advice. We do whatever it takes to guarantee our liability and superior ongoing private client support every day.

Japan Health Insurance Recap

While health insurance is mandatory in Japan (note: by an agreement with certain countries, this enrollment can be waived), it is also pretty easy to obtain affordably (which isn’t always the case in other developed countries). This is largely due to the fact that all medical fees (including surgical procedure fees and medical prescriptions) are reviewed and regulated by the Ministry of Health, Labor and Welfare, as well as the Central Social Insurance Council. There are exceptions, however, such as getting a dental crown or vaccinations (e.g., the flu shot), as these are not covered by insurance.

©https://www.realestate-tokyo.com/living-in-tokyo/japan-medical/health-insurance/